Posted on 8:28 PM

The Lucknow police arrested seven persons on Sunday night for fraud. But no police officer knew who had been their victims and when and where the alleged fraud took place.

Those arrested included two activists of the People’s Union for Human Rights (PUHR) — Vinod Yadav and Sarafaraz — from Azamgarh. They had participated in a dharna at Azamgarh on October 6 against alleged harassment of innocent people in the name of fighting terror.

Others arrested with them, according to the police, were Badre Alam and Bal Govind from Azamgarh, Rizwan and Azam Ansari from Deoria, and Paras Nath from Barabanki.

PUHR activist Shahnawaj Alam said while Vinod and Sarfaraz belonged to his organisation, he did not know about others. He alleged that the two of them had been framed. “We had informed senior police and administrative officials about these persons having gone missing two days ago,” he said. Vinod’s brother Raju said he left Azamgarh on Thursday, telling his wife Sarita that he had some work in Lucknow in connection with his NGO, Karvan. Sarfaraz had gone with him.

On Friday morning, Vinod’s cellphone went dead, Raju said. Later, his PUHR colleagues informed the police.

Sub-Inspector Deshraj Khanna of Alambagh police station said the police had arrested the men after a tip-off that some persons involved in fraud were coming to the Alambagh bus stand.

“We cordoned off the area and arrested them. A golden power, weighing about 250 gms, was seized from them. They used the powder to cheat people, telling them they could convert ordinary objects into gold,” said Khanna.

But even senior police officers had no idea whom the arrested persons had defrauded and when.

Circle Officer Virendra Kumar said, “I have to check the details”. ASP (East) Harish Kumar said, “I don’t know much about the case.” The IG of Lucknow zone, AK Jain, said he was “not aware of the details”, while ADG Brij Lal refused to comment.

National general secretary of People’s Union for Civil Liberties (PUCL) Chitranjan Singh said: “Vinod was present for the dharna at Azamgarh. We will fight against injustice done by the police.” The PUCL and PUHR had jointly organised the dharna. Defence lawyer BK Jaiswal said the accused have been remanded in jail custody for 14 days.

Source: Express India

Posted on 8:19 PM

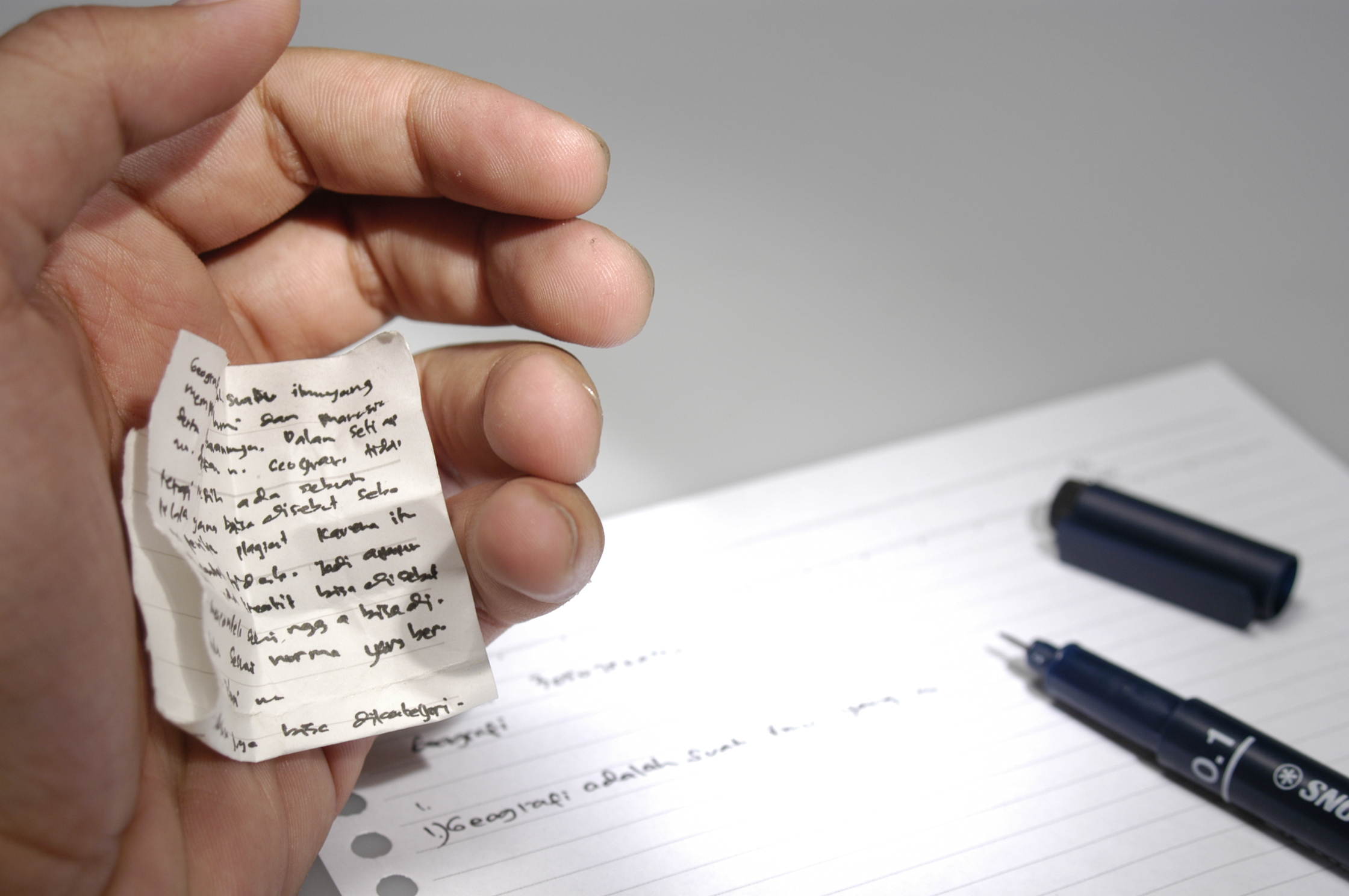

TECHNOLOGY IS here to address two of the biggest issues that education in India is facing- leakage of question papers and forgery of mark sheets and certificates.

Institutions like Bangalore University and Visveswaraya Technological Institute are considering a technology that will enable them to print question papers at the examination venue just an hour before the test.

According to a private research, 68 per cent of middle class students and 75 per cent of high school students cheat in general during examination.

Why is cheating so high? The only way to get to the bottom of this problem is by analysing the problem from the students point of view.

What motivates him to cheat? The decision is guided by his emotions. Cheating cause a feeling of guilt, yet, securing good grades and marks gives one satisfaction.

If the feeling of guilt exceeds the feeling of satisfaction, the student does not cheat. Emotions rise on one’s values and ideas. The basic idea behind cheating is that morality is a dichotomy of self-interest versus self-sacrifice. Cheating is considered to be a “selfish” thing to do, which leads to an advantage of rising in life.

The ’rational’ thing to, either justified by godly rewards, effective considerations, or a gauche appeal to social harmony, requires an instantaneous personal sacrifice.

In this situation of moral clash, the choice is understandably difficult for students to justify. Without rational ideas to justify honesty and integrity, hard-working and ’practical’ students believe that morality only holds them back from success in life, and that they can “play by the rules” once they are out of school, and give lip-service to morality when it comes to more abstract and non-practical matters.

It is a dreadful fault created by bad and irrational philosophy. The concept which students need to understand is that the choice between the practical and the moral is a false dichotomy. Morality is the rational way for a successful life, not an impediment.

Teaching the practical ’selfish’ value of honesty is the best way to discourage cheating. Students must understand that it is selfish and hence beneficial for them to be honest, and to cheat is selfless, wrong and irrational.

The first and foremost purpose of education is to inculcate the practical knowledge and thinking abilities that allow success in life and career. Cheating aborts both goals. In a career, success or failure has materialistic consequences on one’s work and the people it affects. A percentage in biology exams is just a number, but a doctor like Munna Bhai M.B.B.S who takes shortcuts with patients, or a construction engineer who takes shortcuts with buildings, or a politician who takes shortcuts with the voters endangers both his career and other people’s lives.

The vital aim of education is not a mark sheet, but practical skills and knowledge, and cheating dispossess oneself of that knowledge. The short beneficial consequences of cheating are outweighed by the long-term harms. Teachers are required to stress on the rationality of the practical values of their lessons, and the harm the student do to themselves when they forfeit their education.

Student thinks, they deceive others by cheating and gains profit, but cheating is a form of self-deception, it is self-destruction. Cheating in future will cause oneself to lose a grip of what his skills actually are. Someone who cheats during the mid-term exams will find out that he is unprepared for the final exams.

Those who cheat at entrance level competitive exams will find themselves helpless during the higher class exams. The more a student cheats, the more of a moron and ignorant he becomes of his actual knowledge, though he feels like he is very smart! Its simple self-destruction and hence immoral, while ’selfishness’ is to be honest, and ’selfishness’ is a virtue, the morality of life.

The more forward a student gets by his falsehoods, the harder he has to work in order to maintain his unearned position. Even if his fraudulently earned degree or diploma may get him a dream-job, he will still be unqualified and undeserving for it, and forced to continue his deception and cheating at work. He will attempt to hide his inadequacies and worthlessness from his co-workers and bosses just as he hid it from classmates and professors.

Cheating is an addictive habit like alcoholism which turns out to be a sickness that will surely destroy a career even if it does not destroy the cheaters fraudulent and unearned marksheets.

Honest students compete on the basis of their skill and hard work.

Their mutual excellence inspires and motivates among themselves to success and brilliance. On the other hand, the dishonest classmates and co-workers who cheats. Compete by the standards of who is the better liar, better cheater.

They lose the ’selfish’ goal of education to gain practical and actual brilliance in the chosen subject and their career. Their peers do not inspire and motivate them, in stead it increases the peer-pressure as they create a constant threat of having their lies and cheats unmasked. As the cheaters lose the concentration of their goals, they slip behind.

The solution to the rise of cheating is not technological advance, nor is it to attempt to instill a vague sense of moral guilt, but to explain and prove that cheating is counter-productive and self-destructive. Honesty does not require guilt or the threat of punishment. Instead, selfishness, ambition, integrity, and pride should lead one to success. To be successful is selfish, and honesty is the key success. To be honest is to be selfish!

Source:Meri News

Posted on 12:21 AM

The department of space (DoS) basking in the glory of Chandrayaan-1 has rampantly violated official rules and the Central Vigilance Commission (CVC) guidelines in the last seven years in purchasing goods worth Rs 8,600 crore, ranging from satellite and rocket components to furniture.

Owing to serious flaws in the DoS purchaing system, the Central exchequer has lost crores since 2001-02, and the government rules and guidelines have been given a go-by in the name of space science.The revelation has come out in a performance audit carried out by the Comptroller and Auditor General (CAG). Tabled in the Parliament on Friday, it is the first detailed performance audit for the DOS since 1986. One of the most astounding instances of flawed purchase practices is giving away advances to suppliers. In the last seven years, DOS has given away almost Rs 438 crore as advance to its suppliers in complete violation of the CVC guidelines.

In 163 cases, advances were given more than 15 years ago, but the bills have not been settled so far. In 242 cases, advances were paid 5-15 years ago, but final products have not been delivered. “In some cases there are disputes.

In other cases supply is pending and surprisingly the DoS has not charged interests in any of these advances despite CVC instructions,” sources told Deccan Herald. Giving away advances in the first place is against the CVC guidelines, which make it amply clear that advance payments should be made only when the monopolistic firms insist and where lead-time is long and considerable investments by the supplier firms are necessary.

But, the ISRO Satellite Centre (ISAC), Bangalore, Space Application Centre (SAC), Ahmedabad, and Liquid Propulsion Systems Centre (LPSC) at Valiamala made advance payments in a “routine and liberal manner without documenting any reasons”, says the report.The DOS units also did not care for obtaining “bank guarantees” before making the payments, even as the DOS’s own purchase rule suggests so.

In 138 ISAC cases (Rs 64.14 crore), bank guarantee expired and in nine SAC cases, the guarantee (Rs 19.51 crore) had already lapsed though the advances were still outstanding.The CAG report shows that the DOS laboratories took the “proprietary” and “single tender” routes even to procure routine items like crystal oscillators, DC-DC converters and arsenic silicon integrated circuits (ASIC) for which multiple vendors exist. DOS went for public tendering in only four per cent cases.

But believe it or not, the SAC has taken the “proprietary route” to purchase furniture from Godrej and Boyce. “One can understand buying critical technologies, which will be proprietary. But, why the proprietary route for Godrej furniture,” asks an official.In numerous cases, the DOS laboratories did not club their requirement and ended up buying the same component from different vendors at different prices. Also, the stores were not checked properly leading to repetitive buying of the same item.

The SAC admitted that such things happened because different divisions did not have an idea regarding the kind of projects others were implementing and what they had purchased.

Source:Deccan Herald

Posted on 12:12 AM

Former Sikkim Chief Minister Nar Bahadur Bhandari was today convicted alongwith nine others, including an IAS officer, by a designated CBI court in Gangtok for bungling in the state water scam, leading to a loss of Rs four lakh to the state exchequer.

The court sentenced Bhandari and the then state Rural Development Secretary P K Pradhan to six-month imprisonment alongwith Rs 10,000 as fine.

Eight private contractors were also sentenced to five-month imprisonment and a fine of Rs 5,000 was slapped on them by the court.

The case was registered against the former chief minister and 15 others in 1984 and the chargesheet was filed in 1994. However, the trial could not begin as Bhandari and others filed several pleas in various courts including the Sikkim High Court.They were charged by the CBI with criminal conspiracy, criminal misconduct and corruption. While two were acquitted, four contractors died during the trial period.

According to the CBI here, Pradhan, in connivance with Bhandari, had awarded the works of rural water supply scheme in Sikkim to contractors on exorbitant rates ignoring recommendations of engineers and the lowest rates of deserving contractors, causing loss to the state exchequer.

Eight of the accused had challenged the order of the Special Judge, Gangtok, for framing charges against them.The State Government during 1983 had sanctioned 36 rural water supply schemes under the minimum needs programme, involving an expenditure of about Rs 1.62 crores.

Irregularities were found in 12 schemes. Bhandari and Pradhan alongwith contractors had entered into a criminal conspiracy abusing their official position as public servants and caused pecuniary advantage to the contractors by awarding the contracts on higher rates, the agency said.

Source:PTI

Posted on 12:11 AM

Cybercrimes and phishing — emails aimed at stealing your online banking passwords — are on the rise on the back of the global financial meltdown.

Sample this. Five cyber-thieves, allegedly part of a network that hacked into the account of a Noida businessman, were nabbed today for a Rs 1.66 crore cyber hack.They used internet banking to transfer the money from the businessman's account with the Punjab National Bank's Noida branch to their own account.The police only recovered Rs 55 lakh, and have exhorted the public to change their online banking passwords frequently.

A report by MessageLabs, a leading security services company, indicates that phishing attacks rose 16 per cent between August and September and skyrocketed 103 per cent between September and October.Most of the attacks were spoofs on the huge banks dominating the news in the wake of the financial crisis on Wall Street: Bank of America, Wachovia, Chase Manhattan, Washington Mutual, and even UK banks like Lloyds TSB and RBS.

The spam attacks are built around mortgages, debt consolidation, credit counselling and other financial advice.

"There is a distinct connection between the rise in phishing and the downward movement of the stock market," said Pavan Duggal, Supreme Court lawyer and cyberlaw expert. Duggal himself gets around seven phishing emails a day.

A recent report by security firm Symantec indicates that there were more than 400 unique phishing attacks on reputed Indian banks in the last six months of 2007. Out of these, some of the attacks involved the use of compromised ‘.gov’ servers to launch phishing attacks on other brands.

Scamsters are now using every avenue to milk the cow. Under normal circumstances, users are more alert. “But when there's a banking crisis, a simple email saying ‘you need to change your password to protect your account’ can unnerve a user and make him/her click on a link that can lead to hackers siphoning off the money online," Duggal explained.

Penetration testers, who work with bank clients, confirmed that the fragile state of the banking community is making it particularly easy to dupe anxious bank employees.Palakirti Venu, sales director (India & SAARC), F-Secure, a penetration testing firm, argued that targeted electronic attacks like spear-phishing are simpler in this nervous financial climate.

"We do foresee a rise in phony emails about the latest news in the financial markets, as well as with links purportedly to information on how their bank is doing better than its competitors in this crisis," he said.It's not just restricted to browser exploits or web-borne exploits, but also includes infected spreadsheet, PDF, and Word attachments supposedly providing information on the crisis or the bank.

Vijay Mukhi, chairman of Ficci’s IT Cell, agreed. "Cybercrimes do tend to rise during these times since people who are facing bad times would like to steal money by any means. Banks generally do not report such crimes since it can cause them embarrassment and strike fear as far as account holders go."

Kartik Shahani, regional director, McAfee (India), said with employees being laid off in large numbers, there is a stark possibility of a few transforming into spammers and cybercrime for the lure of money.

"Many of those who have been laid-off have the technical expertise and also know their organisation's security systems. The holiday season tends to be busy for socially engineered-types of malware," Shahani said, and added, "The economy is hurting people's finances and this could encourage criminals to up their efforts to gain more money through illicit means."

Scamsters are apparently attempting to manipulate the news to their advantage by asking end-users to revise their account details. “In some instances, they are tricking users into going to malware-laden websites, which resemble the legitimate sites," said Shahani.

"Phishing and social engineering attacks are the highest risk currently faced by the financial industry," Venu cautioned.

Source: Business Standard

Posted on 12:07 AM

Delhi-based hotelier Ravinder Singh, one of the main accused in the cash-for-judge scam that rocked the city in August, was questioned here Wednesday by a three-member committee set up by the Supreme Court to probe the incident.

He was questioned in camera for over four hours at guesthouse here. Mediapersons were not allowed to enter the premises and there was no media briefing on the proceedings.The committee comprises Allahabad High Court Chief Justice H.L. Gokhale, Jammu and Kashmir High Court Chief Justice K.S. Radhakrishnan and Justice M.B. Lokur of the Delhi High Court. It was set up by the Chief Justice of India K.G. Balakrishnan.

The Punjab and Haryana High Court was hit by the scam after a packet containing Rs.1.5 million in cash was delivered Aug 13 at the Sector 11 residence of newly appointed high court judge Nirmaljit Kaur. She complained to the police and a case was registered.The police later arrested the (then) Haryana additional advocate general Sanjeev Bansal, a property dealer Rajiv Gupta and Ravinder Singh in this connection.

Bansal and Gupta told the police that the money was meant for another high court judge, Nirmal Yadav. They claimed that another packet containing Rs 1.5 million was separately delivered to Yadav at her Sector 24 official residence last month.

They had claimed that they delivered the money to the judges on instructions of Singh, who has denied in court that the money was his.This is the second time the Supreme Court committee has come here to probe the scandal. The committee's probe is separate from that of the Central Bureau of Investigation (CBI) into the case.

Singh is still in prison while other accused, including Bansal, his assistant Parkash Ram, property dealers Rajiv Gupta and Nirmal Singh are all out on bail.

Source: Fresh News

Posted on 12:05 AM

Desperate to get into reputed engineering colleges, three meritorious students resorted to dubious short-cuts. They risked their

careers and got themselves false income and caste certificates during counselling. But their luck ran out out when their scam was confirmed by the Karnataka Examination Authority (KEA) after tip-offs.

Avinash (name changed) secured a 5,000-odd rank under CET-2008. Belonging to 2A category, his father is an assistant engineer and mother a software engineer. The total annual family income is Rs 10 lakh. However, during counselling, he produced a false income certificate stating the annual income as Rs 1.85 lakh because he wanted to get a seat in PESIT.

He did get a seat there, only to land in trouble. KEA officials received an e-mail stating that the family's annual income was higher. A show-cause notice was issued to Avinash and after verification, the allegation turned out to be true. Officials cancelled the seat he'd selected in the first round of counselling.

In another instance, a student belonging to 3B category wanted an engineering seat in Bagalkot. He produced a false income certificate of Rs 1.5 lakh when his family's annual income was Rs 2.75 lakh. A person called up the KEA office and informed them about the problem. During the inquiry, the student admitted to the con.

In the third case, the student submitted a fake caste certificate. He actually belongs to the 2A category but produced a caste certificate under 1A category. This boy's father is an assistant engineer.

A KEA official said these students opted for such methods as they wanted seats in premier colleges. The official added that except for SC, ST and category-I, the annual income of parents under other categories should not exceed Rs 2 lakh.

"There have been instances of students claiming seats by producing false caste or income certificate, and getting caught during verification. They won't be allowed for counselling till they get the original documents," the official said.

No criminal case has been filed against the three students. "By doing so, their careers will be ruined," the official added.

Source:TOI

Posted on 12:04 AM

Karnataka government decided also to set up the Special Investigation Team (SIT) to probe the alleged diversion of 17,000 tonnes of rice received by the state under Food for Work programme of the Centre.

The scam was broke out four year ago during the Congress rule in the State and NDA Government at the Centre. The probe is likely to embarrass the Congress leaders since the scam occurred in Mangalore in 2004 during the S.M. Krishna Government.The CoD which investigated the scam filed "B" report (no case report) before the Chief Judicial Magistrate in Mangalore last year and the session court set aside the report, Home Minister V.S. Acharya told reporters here on Tuesday.

The session court in April last had asked the Central Bureau of Investigation (CBI) to probe the issue, but the CBI declined to conduct the probe citing "resource crunch" as reason, Dr Acharya said.Out of a total of 14.5 lakh tonnes that was allotted to the State under the Sampoorna Grameen Rozgar Yojana (SGRY), 17,000 tonnes of rice was illegally diverted.

After a major investigation was launched by the Karnataka Corps of Detectives (CoD) into the massive diversion and export of rice earmarked for drought-relief programmes in Karnataka in 2004, a total of 28 arrests have been made by the police in the case. The investigation has nevertheless unearthed what could be one of the biggest corruption scandals of the S.M. Krishna government, and a shocking case of private profiteering directly off the entitlements of the poor.

The investigation has thus far exposed what the police sleuths call "the tip of the iceberg", namely, the diversion of 17,000 tonnes of rice - the rough equivalent of 34 lakh person days of work - out of a total of 14.5 lakh tonnes that was allotted to the State under the Sampoorna Grameen Rozgar Yojana (SGRY).Allegations of corruption in and mismanagement of drought-relief schemes, including the SGRY, were made repeatedly against the Krishna regime by the political Opposition and some sections of the media.

The State had been declared drought-affected for three out of the five years of the Krishna government's tenure. However, in the absence of concrete proof of corruption, these charges were dismissed by the then government as "politically motivated".

Source: Mangalorean

Posted on 12:02 AM

Karnataka Government on Tuesday has ordered Corps of Detectives (CoD) inquiries into three major crime incidents that occurred in the State for the past few weeks.

BJP Government led by Chief Minister B.S. Yeddyurappa has ordered CoD probe into - fire incident at St. Anthony's Church on the outskirts of Bangalore, death of a farmer from a stray bullet in Hoskote, and killing of two persons allegedly by naxalites in Udupi district.

Home Minister Dr. V.S. Acharya told journalists at the Sate Secretariat that the CoD probe will help the Government to come clean in three cases. It was decided to conduct the CoD probe into the fire incident occurred last week at St. Anthony's Church at Yadavanahalli under Attibele police station jurisdiction on the outskirts of Bangalore.

The church authorities decried the incident and termed it as handiwork of by anti-social elements. Copies of Bible and musical instruments were destroyed in the fire at the church. The Christian association demanded a probe into it. The Karnataka police said that the fire was caused by an electric short-circuit. "The Government has nothing to hide, the probe will unravel the truth," Dr. Acharya said.

The Government has already ordered a judicial probe into the attack on churches and prayer halls and the consequent violence in the state last month.

The Government has also ordered a CoD probe into death of a farmer after being hit by a stray bullet near the Police Training Centre at Haralur, near Hoskote last week. Subbanna (52), a resident of Solur, was killed by a stray bullet near the Police Training Centre at Haralur, near Hoskote. Recruits of the Karnataka State Reserve Police were being trained in rifle shooting when the incident occurred.

The CoD probe was also ordered into killing of two persons allegedly by naxalites at Sitanadi village in Udupi district during the elections to the State legislative assembly last May.

Bhoja Shetty and Suresh Shetty, who had gone out for shopping, were returning home on a motorcycle, when the suspected naxalites opened fire at them. While Bhoja Shetty was a teacher, Suresh Shetty was an agriculturist. However, the people in the district alleged that the police killed two persons in a fake encounter.

Dr. Acharya said the CoD probe will help the government to identify the real culprits behind the attack of churches and also the death of the farmer near Hoskote. The CoD would be directed to complete the probe in a time bound manner, he said.

Source:Mangalorean

Posted on 12:01 AM

After four-and-a-half years, a Special Investigation Team (SIT) will probe afresh the rice scam, one of the biggest frauds in the

state, thanks to a Mangalore court.

In May 2004, the state was rocked by news of diversion of 17,000 tonnes of rice earmarked for drought-relief programmes.

The rice had been allotted to the state under the Sampoorna Grameen Rozgar Yojana (SGRY). The objectives of the centrally sponsored scheme, launched in August 2001, was to provide employment in rural areas through food-for-work programmes.

Instead, those involved in the fraud planned to export the rice to Mombasa, Kenya, through a Delhi-based firm. A Switzerland-based company had placed the order for the consignment.

After seizing the rice, the police filed four first-information reports, three in Panambur and one in Mangalore Rural police stations. Looking at the gravity of the case, it was later handed over to the Corps of Detectives (CoD) for investigation. After more than three years, in 2007, the CoD filed a ‘B’ report (holding nobody guilty) before the CJM court in Mangalore. Upset over the shoddy investigation, the court rapped the CoD and directed the CBI to take over.

Home minister V S Acharya said the CBI declined to take up the case, citing resource problems. Meanwhile, the sessions court in Mangalore set aside the CJM order and directed a fresh investigation under the supervision of the CJM.

Source:TOI

Posted on 12:00 AM

A special Delhi court on Tuesday ordered framing of charges against former minister of state for Urban Development P K Thungan and 17 other co-accused in connection with a case of out-of-turn allotment of houses to government employees during 1993-1995. "Prima facie, I find sufficient material to proceed with the criminal trial of all the accused persons," said Special CBI Judge R K Yadav, making it clear that none of the 18 accused, including the Congress leader, merited discharge from the case.

"Vide separate order, I have dealt with the framing of charges against the accused," said the court which would formally frame charges against them on November one.

Besides Thungan, 17 others, including the then additional personal secretary of Urban Development Minister Sheila Kaul, were named as accused in 1996 by the probe agency for allegedly receiving illegal gratification from around 102 government employees for granting out-of-turn accommodation.

All the accused have been booked under various provisions of the IPC and the Prevention of Corruption Act, dealing with cheating and accepting illegal gratification.

The court hinted that it may take exception of the CBI's chargesheet in which some of the suspects have been given clean chit and their names did not figure in the list of the accused.

Earlier, it had imposed a fine of Rs 3,000 on Thungan while cancelling the non-bailable warrants which was issued against him after he failed to appear during earlier hearing.

The FIR was lodged on February 14, 1996 following a Supreme Court order on a public interest litigation (PIL) challenging the controversial government policy on house allotment.

Source:The Hindu

Posted on 11:58 PM

The state Vigilance and Anti-Corruption Bureau today registered a case in the bitumen supply scam of 2007-08, which is expected to run into several crores. The FIR in the scam has been registered against officials of the Public Works Department (PWD) and Chandigarh-based transporter company M.K. Enterprises, who have come under the scanner for their involvement in the scam.

Though the scam pertains to the entire state, the first case has been registered for Una district, where a supply order of about 900 bitumen drums worth Rs 35 lakh went missing on the way to their destination.

DIG (Vigilance) Ashok Sharma confirmed that the case has been registered for cheating, forgery and criminal conspiracy. “No PWD official has been named in the FIR so far as further investigations would pinpoint the ones involved in the scam at various levels,” he said. He added that the inquiries in the scam for other districts were also in process and soon a chain of separate FIRs would follow.

Him Agro Industries Corporation, which was the nodal agency for procuring supplies, had also made an aborted attempt to register an FIR against the transporter company here at Shimla East Police Station. Sharma said since the scam was already under investigation with the Vigilance, there was no need for a separate case, so it was turned down.

Sources say that later stages of investigation would involve questioning of several officials from the level of junior engineers to engineer-in-chief.

The scam pertains to supply of thousands of litres of bitumen from Panipat refineries that was inordinately delayed and in some cases went missing, whereas payment for the stock was released by the PWD before receiving the supply.

As per the tender, all supplies were to be transported within five days after which a fine of Rs 10 per day was to be imposed on transporters, but Him Agro Industries, did not take any action for the delay, though in many cases the delay was of over six months. The role of Him Agro would also be investigated.

Source: Indian Express

Posted on 11:52 PM

An investigation has been launched into an Indian travel agency, which allegedly tried to con 500 people out of money by advertising fake jobs in Bahrain.

It is believed that the firm planned to collect recruitment and visa fees from 492 Indian workers by promising them jobs that didn't exist.Flyway Tours and Travels (FTT), a Kerala company, allegedly advertised jobs at the Bahrain-based Alfouz Contracting Company.

However, the Bahraini firm has denied any knowledge and says it has never dealt with the firm.

It also claimed that investigations had revealed the company was not even registered with India's Labour Ministry.

"From our investigations, we learnt that no such tours and travels company has been registered with the Indian government," said Alfouz Contracting Company general manager Jimmy Joseph.

In the letter, FTT claims to have received the power of attorney to recruit 492 workers for our company,It was signed by someone called A Salahudeen, the proprietor. With this request letter, they had also attached a copy of a fake letter claiming to be from our company, authorising FTT to recruit on our behalf in Kerala. We were shocked to see the letterhead of our company, which they had forged. They had also stamped a forged seal on the letter. The letterhead also included our company's Bahrain address, telephone and fax numbers, e-mail address and CR (Commercial Registration) number. But anyone who compares our original letterhead and seal with the forged ones can clearly see the difference.

He said the alleged scam came to light when FTT approached the office of India's Protector of Emigrants (POE) in Thiruvananthapuram, Kerala, seeking permission to advertise job vacancies at the Bahraini firm and interview applicants.

The POE contacted the Indian Embassy in Bahrain to confirm that Alfouz Contracting Company was indeed planning to hire workers.

When the embassy contacted Mr Joseph, he said he had never even heard of FTT.

"Someone from Kerala tried to use our company's name to cheat people who wanted to work in Bahrain," claimed Mr Joseph.

"Flyway Tours and Travels submitted a letter on October 11 to the POE office seeking permission to conduct interviews to recruit people from Kerala.The letter was typed on a paper with the FTT letter-head and a seal. The letter-head says that the FTT is approved by India's Labour Ministry along with their registration number."He said another fake letter to the POE listed the company's requirements for workers, along with details of their contracts".

"We want everyone to know that we have never heard about this travel agency before this incident and thus have nothing to do with it," added Mr Joseph.

As far as we know, they are fraudsters trying to cheat people out of their money by promising jobs.

"We understand that the tricksters were trying to get permission from the POE to conduct job interviews and advertise vacancies in our company so they could collect money from applicants on the pretext of recruitment and visa fees and flee".

"We are really lucky as embassy officials informed us about it on time, based on information from the POE. After we denied even knowing the fraudsters, the embassy assured it would stop the scam, as well as take all possible steps to track down the culprits."

The company has also lodged a formal complaint with the Indian Overseas Affairs Minister Vayalar Ravi, Kerala State Chief Minister V S Achuthanandan and Kerala State Home Minister Kodiyeri Balakrishnan.

An Indian Embassy official said he was aware of the case and that an investigation had been launched.

"We are aware of this case and are following it up with the concerned authorities in India," he said.

Source: Gulf Daily News.

Posted on 11:51 PM

The Enforcement Directorate has filed a complaint before the Adjudicating Authority under the Prevention of Money Laundering Act against some of the accused in the IPO scam. These accused entities’ shares have also been attached, said an ED official.

The IPO scam is related to certain entities cornering IPO shares (in 2003-2005) reserved for the retail category by using fictitious demat accounts. These demat accounts were then ultimately transferred, through key operators, to the financiers of the scam. The financiers made their gains on the first day of listing of these shares.

Investigations

“We believe that some of the shares were passed on to the ultimate financiers and even sold in the market. We are tracking the trail of how the money could have flown,” said the ED official.

There are now several investigating authorities throwing the dragnet around the accused and their assets related to the IPO scam. SEBI, the securities watchdog, is itself in the midst of an enquiry into the intermediaries, key operators and financiers in the scam. The board has frozen several of these entities’ demat accounts and also debarred the accused from transacting in the equities market.

An income tax official said that department was looking into “all the persons” involved in the scam and examining their I-T returns. It is believed that the I-T department has also sounded out SEBI on attaching the accounts of some of the accused.

The Central Bureau of Investigation has already filed a charge-sheet against 22 accused in the IPO scam in a Mumbai Court. However, the CBI charge-sheet is against intermediaries and key operators, and does not mention the financiers, said sources.

The officials from the ED and IT department said they would be investigating all the entities related to the case, including the ultimate beneficiaries or the financiers. However, it would be difficult to crack the “layering” in the scheme of things (locating the ultimate financier), said an official close to the investigations, reports.

Source : The Hindu Business Line

Posted on 6:43 AM

Following huge irregularities in the repair works of Shiradi Ghat section (between Sakleshpura and Uppinangadi) of the National Highway road No. 48, main road that provides link between Mangalore and Bangalore, the Karnataka High Court on Monday instructed the Central Bureau of Investigation (CBI) to investigate into the scam.

Residents of Dakshina Kannada and Udupi districts had several staged protests opposing the poor quality of repair works undertaken by the firms during the last summer. The Centre had released Rs. 40 crore for repair the road.

A Division Bench comprising Chief Justice, P.D. Dinakaran, and Justice V.G. Sabbahit passed an order on petitions by B.Krishna Bhat seeking a direction to the Central and State Governments and the National Highways Authority of India (NHAI) to take up repair of the road.

The poor quality of works, incessant rains and movement of heavy vehicles carrying iron ore were said to be the reason for the deterioration in the quality of road, the people said. Minister for Public Works C.M. Udasi maintained that poor design of the road was the major reason for its damage.

The Court has asked the CBI to take up the inquiry along with support from the Central Vigilance Commission and experts from the Indian Institute of Science (IISc), Bangalore.

The Bench directed the CBI to complete the probe within three months from the receipt of the order.

After the probe report, the Central and State Governments have been instructed to initiate action to give contracts for repairing the Shiradi Ghat section within three months, keeping in view the required standards for movement of heavy traffic vehicles.

The CBI was directed to submit the report to the Central Vigilance Commission which in turn was asked to take action against those officers who were responsible for illegal sanction of funds to the contractors in violation of guidelines and norms.

The petitioners contended that the condition of the road had damaged totally and that it would become fully damaged during the monsoon. The Government said they had sanctioned works for taking up works to improve the road and that repairs of different sections had been entrusted to different contactors.

The CBI would look into the issue as to who are the officers responsible for the lapses in monitoring the work and not regulating traffic, the court said and disposed off the petitions.

The 37-km-strethch has been causing inconvenience to motorists and commuters visiting Dharmasthala, Mangalore, Udupi and Kukke Subramanya.

Source:Mangalorean

Posted on 6:40 AM

Srilanka: In a breakthrough in investigations into the multi-million rupee “Sakvithi Scam” the Inspector reported to be a confidant of Sakvithi Ranasinghe was arrested yesterday, police said. Police spokesman Ranjith Gunasekara said the Inspector attached to the Police Communication Division in Mirihana was linked to the scam after he and an armed gang were seen removing several computers and other items from the Nawala office of the financial institution soon after the scam was exposed.

It was later revealed that the Inspector and more than 20 police officers who had invested millions in the finance company, with the Inspector having invested Rs.3,613,000 -- the highest among the police officers.

He disappeared soon after the exposure and is believed to have removed the material to make up for the money he lost.

The Inspector had not reported to work since the scam came to light and failed to appear before the Mirihana police though ordered to do so by Nugegoda Police Senior Superintendent Deshabandu Tennakoon.The Inspector was arrested by a special police team at Talahena Junction in Malambe last morning and was questioned by the Mirihana Police Fraud Investigation Bureau.He is to be produced before the Gangodawila Magistrate shortly.

Meanwhile upto Sunday, 2014 complaints had been received against the finance company with the amount of money invested rising to a massive Rs.1.05 billion.

Source:Daily Mirror

Posted on 11:26 PM

In the latest issue of

Outlook, the Bangalore-based historian Ramachandra Guha uses an academic trip to Norway pen an Oslo diary.

In his first week at the University, Guha speaks at the Nobel Peace Institute where he points out the glaring discrepancy of The Prize not being awarded to the apostle of peace, Mahatma Gandhi:

“After my talk, a lady comes up and introduces herself as a doctor, and an advisor to the Peace Institute. The names I had mentioned were all very good, she said, but surely it was time that the peace prize went to an Indian? She mentions the name of a fellow townsman of mine, a man who has grown long hair, given himself four fancy initials (HH/SS), and whose name is also that of a very great exponent of the sitar.

“The Norwegian doctor had heard that this man had brought peace to Kashmir, and had promoted organic agriculture in thousands of Indian villages. She had been asked to promote his candidacy for the prize, and indeed the man himself had been to Oslo several times recently. She asked me if I would give my opinion on the matter.

“I answered that so far as I knew, there was no peace in Kashmir. I observed that what the West refers to as ‘organic farming’ we knew as rain-fed agriculture—and that ti is nothing new…. Finally, I suggested to the doctor that if not giving Gandhi the prize was a scandal, awarding it to my fellow townsman would be an even bigger scandal.”

Source:

Churumuri

Posted on 11:22 PM

It is a nightmare for any credit card holder. Your card can easily be used by somebody else to make hefty purchases, even fly to exoti

c destinations.

It has become a regular phenomenon in the city with as many as 27 cases registered in various police stations in the city since January 2007.

City police officials describe the arrest of Manish Kakadia as an important development in solving most of the cases as investigators believe him to be well-connected with other online fraudsters.

"He has accomplices in various cities like Hyderabad, Bangalore, Chennai and Mumbai. He used them effectively.

The gang used the numbers in booking online airline tickets and then selling it back on the cyber space. However, the trick was, they used the credit card numbers of one city in another, to wipe out any possible tracks," said JM Yadav, sub-inspector of crime branch.

Officials added that cyber crime experts had traced several transactions of credit cards of Ahmedabad to Mumbai, Hyderabad and Chennai. Officials also gave names of other accused in online fraud.

While Kakadia was present in Ahmedabad, Sonia Chhabra, previously arrested by Satellite police, used to book tickets from Chandigarh and Ludhiana. "Usman Bin Abdullah was in Mumbai whereas we have got names of Yogesh Chauhan and Ratna who operate from Hyderabad. They were in touch via emails and phone calls," said a crime branch official.

Their transaction details are interesting too. Yadav added that the team shared two to three bank accounts accessed by the members. "When they do a good trading, they shared the money afterwards. As some of the members have debit cards, the money was immediately withdrawn from various locations. We are working on the bank account," said Yadav.

City police officials are hopeful of cracking cyber space where the group used to zero in on likely preys and how to use the credit card numbers. The gang also took a lot of precaution after two important members were caught by Ahmedabad police late in 2007, said investigating officials.

Source:TOI

Posted on 11:19 PM

One of the financier and key operator in the IPO scam (2003-05), Kelan Atulbhai Doshi, paid Rs 2.6 crore to SEBI towards disgorgement and settlement charges. Doshi was alleged to have provided money for making IPO applications in fictitious names to corner shares meant for retail investors.

SEBI on Wednesday said that a consent order was passed against Doshi on October 4 and a disgorgement amount of Rs 2.55 crore, being the notional undue gain made by him in the alleged irregularity and Rs 5 lakh as the settlement charges, had already been paid.

Earlier, Doshi proposed settlement of the matter through a consent order in June 2007 after SEBI issued a show-cause notice against him in June 2006 and proceedings in the matter was in progress.

Source:Businessline

Posted on 11:17 PM

B C Mylarappa will return to the sociology department of Bangalore University (BU) after the Supreme Court passed an order to reinstatehim, higher education minister Aravind Limbavali said on."All accusations against him have been found to be false and there is no need for a CoD investigation. I have directed BU to take Mylarappa back and the vice-chancellor will get the order in a few days," he explained.

Limbavali will look also into a case of fraud filed with Ulsoor police station against Mylarappa on charges of misappropriation of funds.

Source:TOI

Posted on 11:13 PM

"Charge memos" have been issued to three IPS officers of Andhra Pradesh, including one additional director general of police, for alleg

edly faking their role in a Naxalite encounter case and obtaining gallantary awards based on these misrepresentations.

The Andhra Pradesh government had issued the memos last week on the directives of the Union government, which examined the matter following a representation from IPS officers of the state in 2004.The officers, who have been issued the memos, are 1977 batch IPS officer A Sivashankar, who was once the right-hand man of the then chief minister Chandrababu Naidu, 1982 batch officer Shriram Tiwari and 1992 batch officer Nalin Prabhat.

All the three officers were awarded the Police Medal for Gallantry (PMG) by the Union government India between 2002 and 2003, but other IPS officers from the state complained that these "gallant" officers were not present at the encounter site.One of the officers was on leave on that day on account of the wedding of his daughter, whereas a helicopter log book showed that another of them was elsewhere, it has been claimed.

Three central committee members of a Maoist group were killed in an encounter in Karimnagar district in the Telangana region in December 1999, but the charge memo refers to the fact that the "gallant trio" was not physically present.The encounter, which had been much in the news those days, was questioned by civil liberty groups, which contended that the central committee members had been picked up by cops in Bangalore and killed in cold blood in the so-called encounter.

Obtaining gallantry awards based on false representation makes officers liable for serious disciplinary action. This includes reduction of rank or pay, or stoppage of increments besides stripping them off the medals. If found guilty, the officers can be prosecuted too. "A gallantry award entitles a cop to goodies worth Rs 3 crore and therefore can be seen as a fraud too," a senior official of the AP government said.The goodies include free land anywhere in India, two automatic salary increments, free AC 1st class travel on trains, 25% concession on Air India travels and even income-tax rebates.

Two of the officers to whom memos have been issued are already in the dog house. Shriram Tiwari was recently superseded by the state government: his batchmates are additional director generals but he languishes as an inspector general in a side posting.Earlier Tiwari had been involved in some other case in North Bengal, where he was posted as inspector general of the BSF. In fact, there were allegations against Tiwari even before he went on deputation to the BSF and questions were asked how he has given cadre clearance by the state government.

Sivashankar is additional director general of the Special Protection Force, a low-profile organisation responsible for the security of state government installations.During TDP rule, he was the eyes and ears of Chandrababu Naidu, being the high-profile intelligence chief.

The third officer, Nalin Prabhat, is currently, on deputation as commandant in the Indo Tibetan Border Police (ITBP).It is learned that the file relating to an inquiry conducted against these officers has gone missing from the ministry of home, but sources said that the Centre has enough evidence to go ahead and direct issuance of a charge memo.

Source:TOI

Posted on 11:13 PM

The Nagpur bench of the Bombay high court on Monday, while hearing a petition of alleged recruitment scam in the Nagpur Municipal Corporat

ion (NMC), has directed the civic body to appoint four petitioners and pay Rs 10,000 to each.

A division bench comprising justices Kishor Rohee and Bhushan Dharmadhikari also directed the civic body to recover this amount from "guilty" officials and if it's not done within a stipulated time it would amount to "contempt of court" , the bench said in its verdict.

In the process, the court has granted relief to four petitioners - Vijay Humne, Ashok Patil, Dipak Pittalwar and Pundlik Dhore. While the petitions of five others - Prashant Dandekar, Mangala Kukde, Rahul Kharabe, Vijay Ghiye and Rahul Rathod - were rejected. However, a petition of Kiran Meshram was given "in-principal " approval for getting his job back.

All the 11 petitioners had challenged the recruitment procedure of posts of ward officer, additional commissioner , junior engineer, assistant structural engineer, technical assistant, plumber, and wireman among others of NMC. A battery of lawyers including M G Bhangde, Bhanudas Kulkarni, and Sudhir Puranik among others represented the petitioners.

According to the petitioners , the civic body had decided to fill up above posts through the examination comprising 70 marks theory and 25 marks oral test. The selection panel had five corporators and four NMC officials.

Source:TOI

Posted on 11:10 PM

When exporter Pavan Kumar Aggarwal checked his bank account in Noida last week, he was in for a shock. A whopping Rs 1.66 crore was mis

sing, he claims. What's more, the money, he alleged, had been siphoned off to accounts in other banks through netbanking the transactions had taken place over a period of five days.

Aggarwal's case got highlighted because of the large sum of money involved. But according to the Delhi Police, the case is not an isolated one and every year, around 200 complaints are received and the figure is rising though few cases are actually registered.

In Delhi, three cases of netbanking fraud were registered till September this year. And a fourth one was filed on Monday. Vivek Bhatia filed a complaint with the police that an amount of Rs 5 lakh had been siphoned off from two different accounts of a leading bank. "I have two accounts with my bank, and on October 10 and 11, money was transferred into other accounts through netbanking,'' he said.

Most of the cases involve an amount less than Rs 1 lakh which are not investigated by the economic offences wing and are instead referred to the local police who are not equipped to handle such cases, a fact disputed by senior officials. "The local police is well equipped to handle such cases. We provide them technical knowledge and assistance is also given when it comes to cyber investigation. More officers of various ranks are being imparted cyber education to handle such cases at the police station level," said an officer.

According to the police, most of the frauds take place due to the carelessness of the customer. "Banks should urgently impart awareness among customer about internet banking. We have been advising banks to take various measures to make their system more safe and secure and at the same time educate customers," said additional commissioner of police (EOW) SBK Singh.

Singh added that customers needed to be very careful while carrying out online transactions. Under no circumstances should they give out personal or official information to anyone claiming to represent a bank in order to avoid phishing scams. The banks also need to upgrade their system to tackle phishing attacks and hacking.

One of the more prominent cases of phishing involved six bank accounts from where money was withdrawn by two persons, including a Nigerian national, in August this year. The two were later arrested by the Delhi Police. The phishing site of Axis Bank was created somewhere in Nigeria in collusion with another Nigerian identified as Kenneth (32) in India. He came to India on a student visa, said police.

Kenneth roped in one Arun Kumar who had an account at the bank's Tughlaq Road branch. The Nigerian used to buy grocery from Kumar's shop and told him that if Kumar provided him with his bank account number, he would immediately pay off his pending grocery bills and give some extra money as well. As soon as Kumar parted with his details, someone in Nigeria floated a fake website of Axis Bank. He then sent emails to six people at different places in India, asking about their account details on the pretext of data upgradation.

Once the details came in, the person in Nigeria transferred money into Kumar's account from the other six accounts through netbanking. Next morning, Kumar went to the branch at Khan Market to withdraw the money but the bank official grew suspicious and detained him. Later, the police registered a case and arrested both Kumar and Kenneth for the fraud.

Other than phishing, another popular method among online scamsters is hacking. Cops investigating Aggarwal's case said his account was hacked and the money transferred. Explaining the modus operandi, a senior officer said, "A hacker is much more than an average thief. He gets into the system with the help of a spyware and steals information. The hacker is always on the lookout for unsecured systems and files. The spyware usually comes in the form of a virus. This spy transports all files pertaining to bank accounts to the hacker. Therefore, it is advisable not to store much information about your accounts on your computer or email which is unsecured."

Another interesting observation made into the frauds was most of the emails originated abroad and in some cases the money was transferred to accounts abroad.

"In cases where the money is transferred to an account in India, we can trace them. But most of these accounts are operated on fictitious names and addresses and the trail goes cold once the money is withdrawn by the accused. Therefore, it is very important for the victim to alert his bank as soon as he notices the fraud. Mobile banking can be useful as it alerts you instantly after any transaction is made," said a senior officer of the cyber crime cell.

Meanwhile, bankers claimed that the technology used by them was not flawed. "Net banking is very widely used these days and over 70% of our customers operate the facility. It involves risks when certain important procedures are not followed. Our branch, however, has never received any complaint or encountered any mischievous incident in this regard,'' said Swati Lakhotia, manager, customer relations, Deutsche Bank, Noida branch.

Generally, an accepted method of keeping hackers at bay is frequently changing passwords. This, however, is not enough. "Customers should make sure that their net connection is secure. Unsecured wifi and broadband connections can be misused by professional hackers to obtain confidential details regarding an account. The best way is to operate your account at home or on a personal computer,'' added Lakhotia.

Another modus operandi adopted by cheats is stealing data from public computers. The fraud here takes advantage of unsecured cyber cafes. Sometimes, the cafe owners are hand-in-glove with the thugs, said an officer.

Some banks have started providing virtual keyboards to deter hackers. And this is particularly helpful while using unsecured connections.

The banks claim that they upgrade their systems from time to time to ensure account security. Piyush Sood, manager, corporate branch, Bank of India, Delhi said, "Recently, our IT department issued instructions to all customers asking them to exercise the virtual keyboard for feeding their PIN numbers. When the PIN is typed through normal keyboards, professional hackers get an opportunity to access the code and identify the characters to operate the customer's account later.'' In case of a virtual keyboard, a grid is displayed on the screen and the password is fed by clicking on the characters.

Source:TOI

Posted on 11:09 PM

Anti-Corruption wing of Central Bureau of Investigation, Nagpur branch, has registered a case against some officials of National Co-opera

tive Consumer Federation (NCCF), Western Coalfields Limited and a private nodal agency after stumbling across a major coal scam involving around Rs 28 crore.

CBI sleuths also conducted simultaneous searches at Mumbai, Nagpur and Akola on Monday in connection with the scam. The concerned officials of WCL and NCCF, in connivance with the private agency, had sold off subsidized coal meant for small scale industries in open market at a higher price. The coal was released under a policy provide cheaper coal to small scale industries needing up to 500 tonnes per annum.

Shiv Sena MP from Ramtek Prakash Jadhav had brought the corrupt practice to the notice of CBI. CBI, which registered the case under relevant sections of cheating, forgery and criminal conspiracy, has been probing the matter for sometime.

The scamsters in WCL and NCCF set up fictitious companies to create forged proof of supply of subsidised coal over a period of time. Several companies, which do not fit the criteria of small scale industry, also received coals.

The practice continued from beginning of 2005 to end of 2007. It is learnt that racketeers siphoned off almost Rs 78 lakh per month in these three years. Central Bureau of Investigation (CBI) officials, who have tentatively calculated the loss, claimed that the exact amount of scam will be known only at the end of investigations.

WCL, the Nagpur-based subsidiary of Coal India limited, was supposed to supply around 40,000 tonnes of coal through NCCF to the SSIs per month. NCCF appointed a private agency to co-ordinate the supply to the consumers. A monitoring committee was also appointed to maintain a check on the disbursement of the coal as per the policy.

Offices and residences of several officials of NCCF and WCL were scanned by the sleuths to recover crucial information and evidence.

The Central Bureau of Investigation is already learnt to have come across clues and mention of several officials of different ranks whose roles are now under scanner. Residence of an accused in Mumbai, NCCF office at Akola, and office of their appointed agency at Dhantoli and the WCL office at Civil lines.

Source:TOI

Posted on 11:07 PM

The Vigilance department is set to unearth an MBBS admission racket in Jharkhand. It involves students who have secured admissions in various medical colleges of the state through proxy candidates appearing for them in written examinations and counselling.

An alleged case of four such students who got admission in the 2008-12 session at the Rajendra Institute of Medical Sciences (RIMS), Ranchi, has come to light. All these students — Ravi Kumar Oraon, Anamika, Charan Oraon and Doly Anjali Sanga — belonging to the reserved quota (ST/SC/OBC) have been expelled and a move is afoot to file FIRs against them.

Official sources told The Indian Express that a Vigilance probe had become inevitable after state Health Minister Bhanu Pratap Shahi recommended it in his letter dated October 11, 2008 to the Secretary (Health). “It is in the interest of the state to inquire into the bonafide of students who have secured admissions in Government medical colleges since 2000,” Shahi’s letter says.

Sources say the case of the four students could be just the tip of an iceberg. In Jharkhand, where there are three government-run medical colleges — RIMS (Ranchi), MGM (Jamshedpur), PMCH (Dhanbad) — 137 students are admitted for the MBBS course every year. The admission is provided after students qualify in the councelling and written test conducted by the Jharkhand Combined Entrance Competitive Examination Board (JCECEB).

Source:Indian Express

Posted on 11:03 PM

A security breach at HSBC's offshore data-processing unit in Bangalore has led to £233,000 being stolen from the accounts of a small number of UK customers.

A 24-year-old worker at the HSBC operation has been suspended after being accused of accessing confidential account information and passing it on to criminal associates in the UK.

Fears of the security of offshore business process outsourcing (BPO) operations will be heightened by reports in India claiming the HSBC employee also used false records to obtain the job at the bank. The HSBC worker was caught when the fraud was detected by the bank's security systems.

A spokesman for HSBC told ZDNet UK’s sister site, silicon.com: "Our internal security team discovered one of HSBC's staff in Bangalore caused customer data to be leaked leading to a small number of accounts from the UK being compromised."

He declined to comment any further on the details of the breach but said all affected customers — reported to be around 20 in number — have been contacted and will be fully reimbursed for any losses.

The HSBC spokesman added: "We are taking data protection seriously. These systems are sophisticated and in place to help track these things down."

Sunil Mehta, vice president of India's IT industry body Nasscom, insisted such security breaches are not unique to offshore operations and can happen in any country.

He said: "India, with its strong legal system and its independent judiciary, is a country that takes this responsibility extremely seriously. Nasscom will work with the legal authorities in the UK and India to ensure that those responsible for any criminal breaches are promptly prosecuted and face the maximum penalty."

Just last month Nasscom created a new regulatory body to help improve data security among India's offshore IT services and BPO companies.

Source: Zednet

Posted on 10:58 PM

A second police official, whose handling of a land scam allegedly involving former Tamil Nadu minister N K K P. Raja was slammed by the high court recently, was transferred on Saturday, officials said.

Deputy Superintendent of Police S. Ramaswamy, attached to a rural subdivision in Erode, was asked to hand over charge immediately upon transfer orders being served on him, according to police officials at Erode, 350 km southwest of state capital Chennai.

Inspector N Vetrivendan, handling the matter under the supervision of Ramaswamy, had been transferred a few days ago.

Earlier, the Madras High Court had slammed the police for shielding Raja's supporters charged with holding four members of a family in an attempt to grab their property worth over Rs.20 million.

Three members of the Palanichamy family including his wife informed the high court and the state human rights' commission that Raja's men had detained them.

As a result, Raja, who has continued to claim innocence, was forced to quit as the state minister for handlooms in July.

Since then, over a dozen of his supporters were arrested following the matter being transferred to the elite criminal investigation department under the direct control of Director General of Police K P Jain.

Source: Hindustan Times

Posted on 10:56 PM

The Rajiv Gandhi University of Health Sciences (RGUHS), which is sitting on the report of the J K Arora committee that probed the internal assessment marks scam of September 2004, has finally decided to place the report before the Syndicate this month.

Taking cognizance of the Express reports on September 25 and 26, the university will table the scam report during the Syndicate meeting on October 24. File notings accessed under the Right to Information (RTI) Act had shown that though the medical education department asked the RGUHS to place a copy of the Arora Committee report before the Syndicate in May 2006, the university hadn’t acted.Meanwhile, Governor Rameshwar Thakur, who is the Chancellor of RGUHS, has sought an action taken report from the State government on the inquiry report submitted by J K Arora, former additional chief secretary.In a letter to the State government written earlier this month, the Raj Bhavan had also sought the status report on the Corps of Detectives (CoD) probe ordered into the scam. Following the submission of the J K Arora committee report in December 2005, the Chancellor had directed the State Government to order a detailed probe into the scam by CoD on February 27, 2006, but no action taken report was submitted to the Chancellor.

The Arora committee had found that the internal assessment marks of 14 students of six medical colleges were tampered with during the September 2004 exams. The probe report had also confirmed that tampering and alterations took place at the computer operators’ level in the computer section of RGUHS.Apart from the Arora Committee, the Chancellor has also asked the government to submit the action taken report on the recommendations made by two more panels __ University review committee headed by former vice-chancellor of RGUHS S Chandrashekar Shetty and task force report on paramedical colleges by C M Gurumurthy, former special officer, RGUHS.

Source: Express Buzz

Posted on 10:45 PM

Education-related discrepancies among the employees in the Indian IT industry has increased during the second quarter of the current calendar year when compared to the first quarter, according to report by First Advantage.

The IT industry has experienced the highest increase (almost 3.5 times) in education related discrepancies compared to Q1 of 2008, First Advantage said in its second quarterly report ‘Background screening trends-India.’

First Advantage managing director (West Asia) Ashish Dehade said, “Background screening acts as a first line of defence against potential fraud and security breaches. More sectors taking it up actively would employ fewer candidates misrepresenting information and thus, concurrently, fewer likely to engage in frauds or security breaches.”

However, this is not limited to just the IT sector alone as educational qualification-related discrepancies in the banking and financial services (BFSI) sector was the highest in the last quarters.

First Advantage said all the key industries tracked have shown an increase in education-related discrepancies. The report said that maximum discrepancies in educational qualifications were related to institutions in Northern India at 34 per cent, followed by Southern India at 30 per cent.

Almost half (48 per cent) of all fake university cases came from Northern India; followed closely by Western India (43 per cent). Pune topped the city list for education-related discrepancies, followed by Mumbai and Delhi.

Source: Indiatimes

Posted on 10:02 AM

Wilson Garden police recently arrested a couple on charges of cheque bounce and forgery. Vinay, a civil contractor, and his wife Rachana, reportedly took a loan of Rs 6.08 lakh from Prashivamurthy of Agrahara Dasarahalli. They promised to return the entire amount within three months.

Prashivamurthy filed a complaint saying Rachana forged a signature on Vinay’s cheque presented to him. He also alleged that the cheque bounced at the Veerashaiva Cooperative Bank. The couple was later released on bail.

Source:TOI

Posted on 10:01 AM

Alcohol can be injurious to you, especially if you try paying for it with counterfeit money. A gang of fraudsters discovered this the hard way when a simple slip-up at an uptown bar landed them - and their illegal business - into the hands of the police.

The police have busted a counterfeit currency racket and arresting six men, including the kingpin and a middleman. Fake notes estimated at Rs3.76 lakh were recovered from them.

Based on a tip-off from Sampige Bar in Banaswadi, police nabbed four persons, who - in turn - provided information on the others involved in the activity. The arrested persons are Venkatesh (36), Venkatraman (32), P Subramani (29), M Sarvar (29), Mustafa Kamal Pasha (52) and Ranganath alias Ranga (43).

As many as 98 currency notes of Rs1,000 denomination and 570 notes of Rs500 denomination were seized in the operation.

"Four members of the gang tried to pay their bill at the Sampige Bar with counterfeit notes amounting to Rs2,000. However, the bar owner noticed it and informed us - which led to the arrest of Venkatesh, Venkatraman, Subramani and Pasha,'' said a police official.

Middleman Mustafa Kamal Pasha (52), a resident of Gandhinagar in Bangalore, who has already been booked once for distributing counterfeit currency notes on Commercial Street, was mediating between scam kingpin Ranganath alias Ranga, a native of Dharmapuri in Tamil Nadu, and the others. Another accused, Sarvar, a native of Chittur in Andhra Pradesh, used to get the fake notes from that state for circulating in Karnataka.

Venkatesh, Venkatraman, Subramani and Sarvar reportedly gave Rs32,000 to the kingpin for the counterfeit notes. They had

already divided the money for circulation in the market, supported by autorickshaw drivers Venkatesh and Venkatraman, who were planning to cheat commuters.

"The fake notes come from Andhra Pradesh and Tamil Nadu. In this case, Pasha had called Ranganath and asked for a consignment of 'the goods', which was duly delivered. We are yet to know if they have already circulated fake notes in Bangalore or other parts of Karnataka. The deals normally take place through telephone,'' said a senior police official.

Two members of the gang, Dhanabal and Chandrashekar, both natives of Tamil Nadu, are absconding. Stating that they have gone into hiding with counterfeit currency notes estimated at Rs28,000, police said Chandrashekar was in charge of printing them.

Source: DNA

Posted on 9:58 AM

The Parliamentary Committee probe into the cash-for-votes scam has found no evidence against Samajwadi party General Secretary Amar Singh and Congress leader Ahmed Patel.

But the all party committee has said that there is a need for further investigation by an independent agency to probe into the role of SP MP Reoti Raman Singh - who reportedly went to the house of the three BJP MPs - and BJP member Sudheendra Kulkarni - who admitted to being present at the time of the sting operation carried out during the alleged attempt to bribe the MPs.

BJP leader VK Malhotra says the members got the Cash for Vote draft report late. So the meeting will now be held on October 17. "The draft has been circulated among the members

The cash-for-vote scam broke just before the Vote of Confidence called by the UPA in July this year.

Amar Singh and Ahmed Patel were accused of horse-trading before the crucial vote in the house.

Source: CNN IBN

Posted on 9:39 AM

-Abhay Rao

“Fraud and falsehood only dread examination. Truth invites it,” said the late 18th century poet Samuel Johnson. Yet, to date, most frauds seem to be out of the scanner, and remain undetected. And, this is not referring to back alley crimes and muggers, but modern thefts that occur under our very noses. Small and ingenious techniques are now being used by scamsters to avoid being noticed and rid you of your wealth. Some of these new age scamsters lurk behind the murky shadows of the cyber world and some use age-old greed baits to lure investors to make a fast buck.

While one may always feel that Indian systems are relatively slack and backward, it took Thirugnanam Ramanathan, a 35 year old originally from Chennai, barely any effort to pull off a high-tech stock fraud scheme that involved hacking into US brokerage accounts to make unauthorised purchases of thinly traded stocks to drive up the price.

Once the prices began to rise, he and his colleagues then dumped their own shares in the same stocks for a profit. At least 60 customers of nine brokerage firms were victims to this scam before Ramanathan was cuffed in Honk Kong and extradited to the US. He slipped up once when one of the instances of stock manipulation was traced to an IP address used by a Bangkok hotel where he was staying at that time. Welcome to the new scam, hack pump and dump.

Such hack, pump and dump scheme hit 60 online stock traders and nine brokerage firms, including TD Ameritrade, ETrade Financial, Firstrade Securities, ChoiceTrade, OptionsXpress, TradeKing and Terra Nova Financial. It was also the first time that such a case was tried, and the guilty, namely Thirugnanam Ramanathan and his accomplices were sentenced to two years in prison. However, by then the damage had already been done, with over $300,000 lost.

A blog at wired.com , a leading technology magazine and website, recently described hack, pump and dump schemes as “stealing candy from a child,” and while India seems to have stayed relatively clear of traditional pump and dump involving spasm instances of pump and dump by way of false rumours, tips, price manipulations and hacking still loom large over all our heads. India, the centre of activity, buzz and financial deals round the clock, now stands firm amidst crumbling financial systems worldwide. A volatile Sensex that has had most guessing in recent times, has been fairly stable as far as safety norms went, ever since the famous “Harshad Mehta” scam of the 90's.

Yet, today, surprisingly so, stock market manipulations, price manipulations, frauds and even pump and dump schemes are rampant. The only difference is, many of these have not gotten into the limelight yet.

“We have the statutes and laws in place to curb these frauds from occurring. Yet, due to lack of implementation, scam gyp investors of their wealth, within the stock market itself,” says Vijay Kevalramani, a chartered accountant and stock market enthusiast for many years now.

As per complaints made by investors at the Cyber Crime Complaints and Resolution Assistance Center of naavi.org , a reputed brokerage firm has been allegedly involved in large-scale investment frauds and there are several other brokers as well. Naavi Vijaya Shankar, cyber law consultant and co-founder of the Cyber Society of India feels, “Hacking and modifying online accounts to dupe investors of their wealth is rampant in India. There are many such instances, which have taken place over the years in various parts of the country.”

What is pump and dump?

Pump and dump scams revolve around illegal activities carried out by an investor, broker, a group of investors, brokerage firms or even promoters at times, to promote a stock they hold.

They try and manipulate the price of the stock, so that it rises due to increasing trade volumes and interest generated. Once the stock is on its upswing, the scammers sell the stocks they hold and make a handsome short-term profit.

These stocks are usually lesser-traded stocks, maybe of some small- or mid-cap companies. These are promoted via tips, rumours and scam messages often claiming the stock to be the next big thing, whose prices will shoot through the roof, based on a pending news announcement, with details to the same.

Each such pump and dump scam has different tactics and information used. However, the general idea behind the scam is the same. The reason why small- and mid-cap companies are the preferred choice is due to the illiquid nature of the stock, allowing the prices to fluctuate easily with an increase in trade volumes.

Once the scammers notice a spike in the demand of the stock, and the steady rise of price that follows, they will wait till the price gets to their estimated level, before selling their positions and holdings in the stock, enabling them to walk away with a handsome short-term profit. The only losers, happen to be the investors who now hold a bunch of worthless shares, as immediately post the big exits made by the fraudsters, and on no “supposed news” ever being broken, panic sets in and the price of the share falls again.

Scam business

No, this is not hinting towards another scam, but the business of scamming itself. Yes, scamming is a business, with plans, profits, targets and all the jazz one can think of. And, one of the prime methods used for scamming these days are the email, which when used for pump and dump schemes, try their level best to promote one company's shares.

Before the email came, such rumors were spread in pubs, trains, Dalal Street and other ingenious ways were used.

One such way that comes to mind is the famous pump and dump scam in the US a few years ago. This involved leaving people messages on their answering machine about a supposed hot stock pick. This message was left in such a way that it appeared to be for someone else and has gotten to that person by pure chance.

Excitedly, most people bought this stock and within hours the price rose by almost 300%. The scammers then sold the shares of that company, which they had previously gotten and managed to make sizable profits. Yes, we Indians are a lot smarter and are unlikely to fall for some lame scam trick most may feel. Yet, all these incidents that have occurred all over the world have little to do with people's intelligence, for it is their greed that has been preyed upon.